Our redaction today share a research conduct by an expert of Estonian properties market. Contact our redaction Magazine & TV to get in touch directly with the market researcher. We also recommend you, if you deal with real estate investments or management, to be part of the REAL ESTATE HUB which includes top renovators, designers and architects who have demonstrated in the past 20 years highest competence and understanding for smartcities concepts. Thank you Movement Smart&Digitalcities.

In this study the case of Estonia properties-market is under exam

– where office and retail properties currently still trade at 8% yields and industrial and logistics 9% yields.

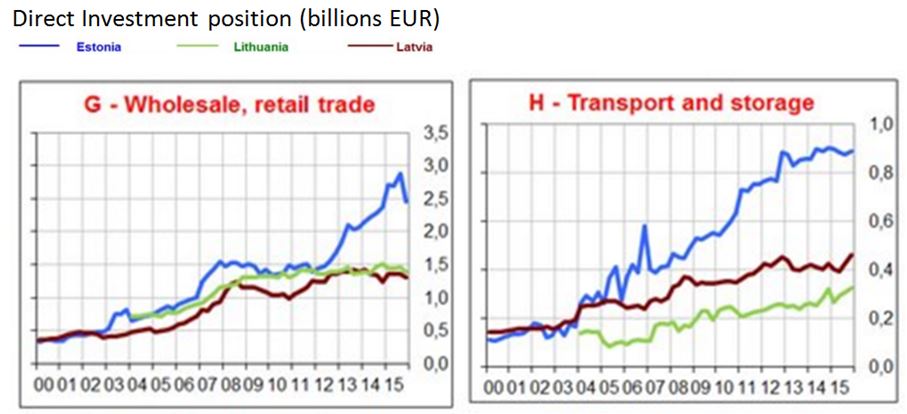

– The transaction volume of commercial property, having peaked at 1 billion euros annually for the Baltic countries during 2006-2007 has recovered to roughly 500 million euros a year. Estonia, being in Northern Europe and neighbor to Sweden and Finland, with their commercial property markets being the most liquid in Europe, is expected to be the fastest to converge with the Nordic markets, followed by Latvia and Lithuania.

– The average transaction costs in Estonia do not exceed 3% of the property value, thus being twice lower than the European 6% average, which favors the rise in transaction volumes and increases the actual returns in cash flow significantly (+0,6(%)pp „hidden extra yield“ p.a. in a 5 year investment).

– The unique system Estonia`s 0% of corporate income tax on undistributed corporate profits has serious accumulative benefits for the investors and has strengthened the capitalization of local commercial banks.

– In addition, the Tax Foundation International Tax Competitiveness Index rated Estonian tax system in general as the most competitive among the OECD countries.

– The possibility to become an e-resident of Estonia starting December 2014, the first country in the world to offer such thing globally, brings additional benefits of being able to establish a company and transfer funds online regardless of location, which helps to run down management costs significantly.

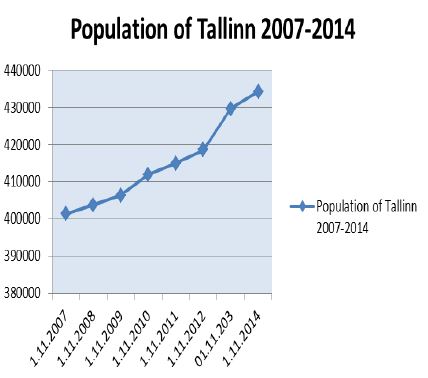

– Tallinn, the capital city and commercial center of Estonia, has witnessed a 8% growth in its population during the past seven years

– and hosts the European #7 busiest passenger port with 8,4 million passengers annually.

– Talsinki stands for the 1+ million metropolitan area of Tallinn and Helsinki combined (with suburbs and greater area almost 2 million). According to FT-intelligence (Financial Times foreign direct investment center of excellence) European Cities of the Future 2014/15: Tallinn ranks #5 in the top 10 European business friendly cities in its category, while Helsinki holds the #2 place in the top 25 European cities overall.

– The integration is expected to deepen by 2022 when the high speed passenger and cargo train link RailBaltic is expected to be ready connecting Tallinn through Riga and Kaunas with Western Europe.

– Meanwhile Estonia continues to be an attractive place for business ranking #17 in the world in the ease of doing business index, #26 among the least corrupt countries in the world (top 15%) according to Transparency International and has the lowest government debt in EU of just 10% and sound fiscal policy, which means that there is no pressure on the government to impose surprise tax hikes for investors to squeeze out money in order to pay back loans and interest.

– The Economist Intelligence Unit predicts higher GDP growth in the Baltics than in the CEE and Western Europe and OECD November 2014 report confirms this, projecting for Estonia an accelerating GDP growth reaching +3,4% in 2016.

– Behind the GDP of Estonia is a diverse and competitive export oriented economy consisting of large players like Ericsson, ABB, BLRT and Tallink. But IT and tech startups – notably Skype, Transferwise etc are playing a growing role. Estonia has also become the biggest exporter of wooden houses in the EU. A new wave of Estonian final end and often luxury products has emerged, featuring for example the Estelon hifi speakers, Bolefloor, Baltic Workboats, Saare Paat sailing yachts and Delta Powerboats or high tech snowplows of Meiren.

Nordic discipline in Estonia

– Estonia also ranks in the top 30% of European countries with the best payment discipline, which gives assurance that the purchase yield will turn into the actual cash flow expected by the property owner.

– Leveraging option in the form of a loan from local commercial banks is frequently used and under current situation the leveraged yield in Estonia can be more than double the standard yield. With leverage option a 9% yield logistics property can easily have a leveraged yield of 18%. This is so because the average commercial bank corporate small loan interest rates as of September 2014 according to ECB were 3,1% in Estonia, which is lower than the eurozone average of 4% (Finland 3%, Germany 3,6, Latvia 4,2%). It looks like Estonia currently has the highest difference between property yields and interest rates on commercial banks loans in the eurozone. The combination of high yields and low interest rates might be a rare window of opportunity for an investor looking at leveraged property investment.

– All this combined makes Estonian commercial property worth looking at.

– Whether it is office, retail, logistics or industrial, spotting the right property with proper due diligence is essential. A good broker can help. Small and medium size investors might have an advantage, which does not exclude the possibility of a large fund entrance, if done with care and more than one country in the Nordic region is taken into consideration.

Commercial Real Estate Estonia

Real estate investments involve also residential property, but due to tougher legal regulations – rent controls in some countries and differences in legal protection of people`s living spaces, though being a viable investment option if you know the market well, it has still substantially lower yields than commercial property and is somewhat more specific asset for international investors and therefore it is left out of the scope if this analysis. Tallinn residential property is quite popular among Scandinavians (The New York Times: Value Lures Investors to Old Town Area of Estonia`s Capital. November 13 2014). One might want to look at it especially if considering relocating to Estonia.

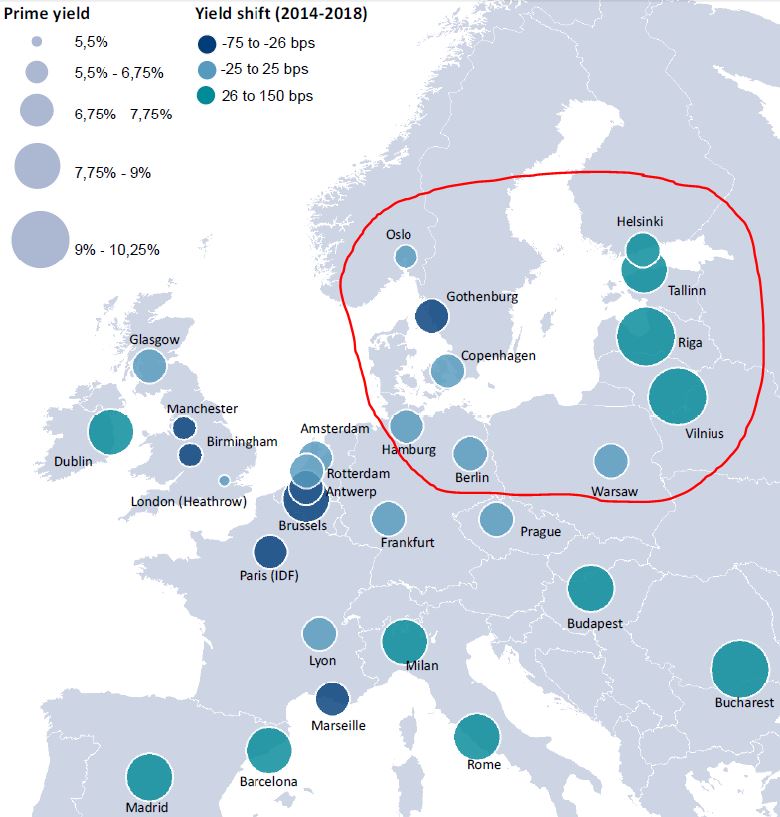

Properties on the Nordic-Baltic markets still showing solid yields

The wave of economic recovery is spreading across Europe and makes it worthwhile for investors to go beyond Germany, UK and even Poland to spot countries where good deals could still be found. Trends in the overall economic performance also affect the state of commercial property. According to the Economist Intelligence Unit, the EU’s compound GDP growth rate should average 1.7% over the next three years. GDP growth in the CEE region is expected to outperform the EU’s forecasts and average 3.3% from 2015 to 2017. (KPMG Snapshot pg 47). The prime yield levels in the Baltics were in the range of 7,5-8% for offices, 7,5-7,75 for retail and 8,9-9% for logistics (KPMG Barometer 2014 pg 29). In Finland the yields are not as high but still relatively strong between 5,2-7,25% according to DTZ. If the prime yields in a number of European core markets are around 4% but in the Baltics properties with yields still around 8% and more could be found, then the 100% higher yield level is a good reason to take a closer look at the Baltic countries Estonia, Latvia, Lithuania.

Key economic and commercial property figures

The GDP per capita (nominal) in Estonia is 14 737€ (Latvia-LV and Lithuania- LT 11 900€) and foreign direct investment stock per capita is 11 971€ ( LV 5000€, LT 4119€). Total new office space in Tallinn is around 615 000 m2, total mall space 680 000 m2, shopping center vacancy rate around 0%, total new warehouse space 850 000 m2, vacancy 3% prime office yields are around 8%, retail 8%, industrial and logistics around 9%, residential investment yield 5,2%. It must be noted though that in some categories there might have been a slight trend for compression of these yields recently. Others, on the contrary predict that yields will remain the same or even rise, perhaps inspired by certain geopolitical trends viewed from far away with little zoom in. That topic perhaps might justify an additional chapter, which is left out of this study in order not to prolong the already very lengthy volume, but the brief conclusion is that this study rather projects that in the coming years the yields will come down to a degree, giving an advantage to those who manage to acquire the property before the yield compression.

For example, residential property in Estonia has already witnessed +20% price increase during 2013, according to the Bank of Estonia. Investor confidence has increased and this is exemplified in the somewhat increased number of property investors within the category who are focused exclusively on buying new properties to their portfolio and not interested to sell any when we approach them in search of properties. Or they are only ready to sell at 5% yield, which is basically saying the same with different words. These signs probably do not show in most market reviews yet. In some rare cases there might still be available commercial property with a long term government tenant, where the yield rate may be also slightly lower, which corresponds to the lower risk level in analogy to government bond yields being typically lower than private loan yields.

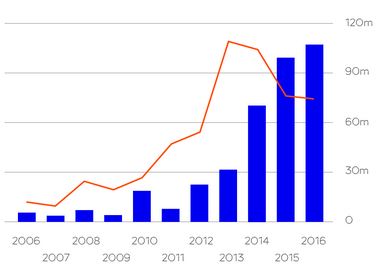

Transaction volume, liquidity and convergence with the Nordic property markets

The total market turnover of commercial property in the Baltic countries in 2013 was around 600 million euros equally distributed between the three countries (DTZ Investment Market Update Baltic States Q1 2014: High investment activities – different investment paths). In Estonia, the total real estate annual turnover in 2013 (transaction volume) was around 2 billion euros (out of which around 200 million euros was commercial property) the volume was up +18% compared to the previous year, according to the Statistics Estonia (www.stat.ee). The total transaction volume of commercial property in the Baltic countries reached its peak in 2006-2007 at around 1 billion euros in total, then dropped to almost a standstill in 2009 and since then has gradually regained its volume, reaching 480 million euros in 2013. The same figure in Finland for 2013 was 2,5 billion euros. For the interest of consistency of comparison I hereby use the more conservative estimates of Newsec.

The population of Finland is 5,45 million and Baltic countries 6,2 million, so there is 4,58 times less commercial property transaction volume in euros per capita in the Baltic countries compared to Finland. It is important to understand what is behind transaction volume numbers:

– One factor that affects transaction volume is the price level of the property. If an analogy with residential markets could be used, then average purchase price per square meter varies significantly – for example in Monaco it is 44,5 thousand (t) €, in Switzerland 11,3 t/€, Sweden and Finland 6,2 t/€, Luxenbourg 5,7t/€ and Estonia 2,37 t/€, according to The Global Property Guide. That makes a 2,7 times price difference between Estonia and Finland and if this could be used as a general theoretical benchmark for real estate then if the price per square meter was the same, the transaction volume in the Baltics were automatically not 0,48 billion but 1,3 billion euros, even if the exact same amount of property in terms of square meters would have been traded between owners.

– Second factor is the amount of property that changes ownership. For example the sale and leaseback option is perhaps not yet as widespread and this could be an additional potential growth area for the commercial property trading market, as more companies might want to free their capital from real estate to focus on expansion in their core competence area.

– A third factor is the total stock of commercial property in its various categories like office, retail, logistics and industrial. The more square meters there are per capita the larger is the total stock of potentially tradable commercial property. The total amount of property in turn is being developed in correlation with the overall growth of economy.

– Fourth, the overall market activity has been strongly affected by the Great Recession of 2009, which virtually halted the market activity in whole Europe and which has already been overcome in European core markets, but the wave is now moving across the Europe. According to Newsec, Finnish and Danish property markets are somewhat behind in recovery compared to Sweden and Norway, which in turn makes the former a good potential for investor to position themselves for the future pick up in the activity.

However if the 2013 transaction volume of the Baltic countries + Finland combined (with the total population of 11,65 million people) of 3 billion euros is taken into account, then comparing it to the volume of Poland in 2013 of 3,4 billion euros and its population of 38,5 million people, the transaction volume per capita even on the current market was roughly 3 times less in Poland.

There are a number property funds present on the Estonian commercial property market in addition to direct private equity. It is estimated that roughly 50% of the commercial property is held by local capital, some 40% by Western European (mostly Scandinavians, but notably also from Italy) and roughly 10% by capital from CIS countries (mostly Russia, this category has seen increase recently). The liquidity on a smaller market is not as high as for example on London property market. On the other hand, this is rewarded with higher yields and yield in the form of cash flow is very liquid again.

Estonia is not (or perhaps not yet) in the very center of focus of the largest funds. This may actually provide an opportunity for small and medium size investors, who would not be making the comparable returns if the large players would start to compete for the properties and drive the prices up and consequently yields down, as has happened in Poland for example. Actually, the liquidity can be in correlation with yields and does not interest an investor who wants to hold on to the property for a longer time and earn high yield in the form of cash flow from the rents. But if the investor is looking for a fast or sudden sale in large quantities then one should look more at the transaction activity, but probably substantial concessions on the yield level then have to be made.

If viewed as a region – Estonia combined with Finland, Latvia and Lithuania one would already today look at a roughly 3 billion euro annual commercial property transaction volume (which roughly corresponds to the total of Polish transaction volume in 2013) , which means even a larger fund could put together a portfolio of properties in more than one country. All those countries being in EU and soon also in eurozone make the national borders less important. If one adds the fact that Finnish government has recently taken over the Estonian central architecture of e-government – the X-road – from Estonia (The Arctic Startup: Finland to Implement the Estonian X-Road Infrastructure 13.09.2013) it may soon be that the benefits of what is described in the e-residency part of this study will one day enable to do business similar way in the whole Nordic-Baltic region.

If however a large fund would enter the market in a loud manner, the consequence will probably be a substantial compression of yields. On the other hand a discrete entrance with a diversified portfolio in more than one country in the region might not rock the market. The size of the market activity are not necessarily in direct correlation with the population size as is exemplified by Luxembourg, Singapore, Switzerland or Monaco, but more related to the dynamics of the overall economic outlook. For example Luxembourg ranks as # 6 top liquid commercial property market in Europe according to DTZ (DTZ: Sweden is Europe’s most liquid commercial property market 11.03.2013), while Sweden is the most liquid market in Europe even ahead of the UK, Finland ranks as top # 8.

Nordic property market is highly liquid in European perspective and in recent years is has accounted for about 15-20% of the total European property turnover

the Nordic property market is highly liquid in European perspective and in recent years it has accounted for about 15-20% of the total European property turnover (the EU total being around 120-150 billion euros, depending from the year), a high level relative to the region`s population which is just over 5% of the total EU population. At the same time Newsec concludes that „in Sweden and Norway however the window of opportunity for property investors „to ride the market“ is now quickly closing, while for example the logistics in Tallinn are currently showing the highest yields in the Northern European region at around 9%“. Newsec sees in the Baltic region opportunities for new investors and points out that the currency risk has been removed after the adoption of the euro in Estonia (2011), Latvia (2014) and Lithuania joining the euro in 2015. The three trends in the Baltics to observe according to Newsec are: 1. Increasing transaction volumes, 2. Rising retail and office rents, 3. Opportunity for high returns with low risk on investment. However it is important to note that rental levels are still in the recovery stage and property values are very reasonable, often at around their development cost. Together with the imminent rise in retail and office rents as well as yield compression, capital values are expected to demonstrate impressive growth thus offering a chance to get high returns on investment within a short timescale.

Continuing convergence with the Nordic countries` economy and price levels leave room for market growth. For example according to BHP Paribas (BNP Paribas European Office Market 2014) in Q4 2104 the prime rents in €/ m2/year were 508€ in Stockholm, 345€ in Helsinki, 204€ in Tallinn and 152€ in Riga. Within growth potential in terms of appreciation the purchase price of property per m2 is central , while the total volume of total commercial space in m2 is more connected to the overall economic growth. In essence it comes down to who can best predict and act where the economy will grow. An additional benefit is that thanks to the lower price level of property, one is able to enter into having a separate individual piece of functional commercial property with a smaller amount of equity compared to Sweden for example, which effectively lowers the barriers of acquiring a direct ownership of a commercial property.

One important point of this analysis is that especially Estonia, but also Latvia and Lithuania, unless the latter would like to position itself more into the CEE group along with its larger neighbor Poland, will converge more and more with the neighboring Nordic countries to a degree where even the term „Baltic“ would start to loose much of its economic content, as geographically they already are as Nordic as one could be. This approach is strongly supported by the latest Newsec report where it states that: „Over time the Baltic property market is expected to converge with the Nordic“.

Transaction costs in a standard purchase deal in Estonia do not exceed a total of 3% which is two times less than the European average of 6%. That alone gives a commercial property in Estonia a „hidden“ extra +0,6 pp (%) yield per 5 year investment period

Without going into further details, the transaction costs in a standard purchase deal in Estonia including all various types of one time transaction costs (including property registration, notary fee, brokerage fee, setting up an SPV if needed) will not exceed a total of 3% of the value of the property, which is two times less than the European average of 6%. If a country would exist where transaction costs are exactly the European average of 6%, then that alone gives a commercial property in Estonia a „hidden“ extra +0,6 pp (%) yield per 5 year investment period. This means that a property with a yield of 8% in a 6% transaction cost country would mean an effective yield of 8,6% in Estonia in this comparison.

There is no annual corporate income tax in Estonia. As PWC has described it, Estonia has a unique corporate tax system since 2000: all undistributed corporate profits are tax exempt (PWC Doing Business and Investing in Estonia 2014 pg 43). 0% corporate income tax is imposed on all reinvested earnings (PWC pg 15). A flat tax of 21% (starting from 2015 20%) is only paid if final dividends are taken out of the company. In practice that means that as long as the profit stays in the company or is used for further investment, no tax applies. This could also be called extra +20% liquidity for the company. OECD corporate income tax weighted average in 2013 was 32,5%.

E-residency: the first hassle free government to opt in

Estonia is known for being a pioneer of e-government, where its people get most of their formalities with government done from home laptop. It relies on three central key elements: the government verified electronic identity (E-Estonia ID card), decentralized automatic exchange of data between all public databases called the X-Road (The Estonian X-Road) and advanced legislation that gives electronic identity and digital signature very strong standing and nationwide standard. On that base most of the popular e-government services function (e-voting, e-tax, establishing LLC online in 20 minutes, digital prescription etc, etc) and have achieved such massive penetration in the population. The recent news is that now we want to offer the same hassle free convenience for people who are not physical residents of Estonia. See e-residency on B2BALTIC TELEVISION

What does the opportunity of becoming an e-resident mean for an international commercial property investor? To put it very briefly, it will enable one to do almost any business formality the way it is being done already by Estonian residents. That means business can be done regardless of where one is located physically, be it another country or the comfort of home office. From a laptop computer with internet a company or its subsidiary can officially be established online in around 20 minutes. Contracts can be signed with digital signature (especially convenient if it is a multi-party agreement with people across different geographical locations).

There is a whole number of reasons why digital signature is much more secure than pencil one, in addition of getting rid of the time and money costs of shuffling the papers around in a medieval way or buying plane tickets. Tax formalities (most Estonians spend on income tax declarations no more than 15 minutes a year) are part of e-government. Identify yourself through e-residency to check the bank account and do bank transfers, including through the worldwide famous platform Transferwise from Estonia (it used to be an Estonian startup, now it is offering international money transfers at a fraction of costs compared to the banks).

If you add to that skype audio and videoconferences (another Estonian invention), you will really need a plane ticket only for the right reasons – to communicate with people face to face, look at the property, feel the air, visit the restaurants and so on. Starting from December 1st 2014 the program will be opened for official e-residency applications.

100% control

There are no restrictions nor special requirements on commercial property ownership for foreign residents. There are also no requirements for the SPV (a special company through which the commercial property is typically owned. This is the most common and convenient option, though direct transfer of property to a physical or legal person is also possible) to have any local management board members. Unlike in some countries, there is also no minimum pay requirements for the board members. If desired, a local trustee can of course be appointed.

During the past years more than 8% growth in the population of the capital city Tallinn

Regarding the cash flow, commercial property has its main value in its tenants who are paying the rent. To estimate the future demand of such property, demographic trends are important. Tallinn, the capital city and main business center of the country, has witnessed a stable and a total of more than 8,2% increase in its population since 2007, from 401 370 in 01.11.2007 to 434 330 in 01.11.2014.

Why Estonia

Tallinn and a number of other cities and towns in Estonia were in 14-17th century members of the Hanseatic League, which is often considered to be the forefather of the European Union (The Economist: Charlemagne – The new Hanseatic League). Hanseatic League was a commercial and defensive confederation of merchant guilds and their market towns that dominated trade along the coast of Northern Europe and included for example the trading cities which we today know as London, Hamburg, Antwerp, Tallinn and Stockholm. It was during the Hanseatic times of a flourishing trade city when the UNESCO world heritage Tallinn mediaeval old town was built.

Estonia is not only geographically a Nordic country, but its history is also very intertwined with the Nordic countries. For example the Danes got their flag „Dannebrog“ from Tallinn in 1219 and the Swedish King Gustav Adolphus founded in Estonia in 1632 the University of Tartu, one of the oldest universities in Northern Europe. Today the Baltic countries are also the observer members of the Nordic Council.

Estonia is one of the 14 countries in the world which have predominantly Protestant cultural background and influences together with for example Finland, Sweden, UK, the Netherlands, USA and Australia. As an anomaly, Estonia is virtually the only one of them not yet in the very top league of economically most advanced countries.

Having been roughly on par level with Finland prior to 1940 and having reached roughly 70% of GDP per capita compared to the EU average during the past 20 years, the most obvious explanation is that it still has more work to do to make up for the 50 years under the Soviet rule. Most famously Max Weber has studied the contribution of Protestant thought on the modern economic system in his book „The Protestant Ethic and the Spirit of Capitalism“. These centuries long cultural and historic influences have according to Weber fostered some general societal mindset and behaviour which translates into a rather straightforward business culture which values honouring the contracts and hard work (on the picture people in Tallinn old town taking a break).

In public finances Estonia has the lowest government debt among the EU countries according to Eurostat (Eurostat government debt to GDP diagram) of just 10% of the GDP, while the EU average is 88%.

Import Export

Estonian GDP in 2013 was a total of 18,4 billion euros, the exports formed 12,3 billion euros and the main export destinations were Sweden (17% of Estonia’s total exports), Finland (16%) and Russia (11%). Electrical equipment and wood and products thereof were mainly exported to Sweden, electrical equipment and furniture to Finland, and mechanical equipment and agricultural products and food preparations to Russia. Exports to EU countries form 71% of Estonia`s total exports, CIS countries (including Russia) 13% according to the National Statistics. The sanctions on foodstuff imports from EU imposed by Russia in 2014 will decrease somewhat Estonian exports within that subsegment, but in parallel work is being done to open new markets.

Estonia as a relatively small open economy tightly integrated with the EU markets relies heavily on exports and its wide economic base has been subcontracting for Scandinavian and Western European companies. The biggest export categories in 2013 were electrical equipment (2,5 billion €), mineral products (1,3 billion €), agriculture (1,2 billion €), wood products (1 billion €), mechanical appliances (0,96 billion), metal and metal products (0,88 billion €). As can be seen from these numbers the top 4 categories form less than 50% of the total exports of 12,3 billion euros, which could be considered a strength, as the economy is very diverse and not dependant on a single or few sources of income.

There is no dominant flagship in Estonia like Nokia used to be for Finland, it is more dispersed between equally strong companies. As to the major multinational manufacturers Ericsson for example which has a global market share of 35% (in 2012) in the 2G/3G/4G mobile network infrastructure market produces most of that equipment in Estonia and has counted at times for almost 10% of the total exports of the country. With more and more audiovisual material being used through smartphones through mobile networks one can predict that demand for updating mobile networks will grow. ABB has a major brand new production unit called „One Campus“ near Tallinn in the Rae industrial district. VKG is the biggest producer of oil and chemicals from the local raw material oil shale (the same source is also used to produce electricity which combined with wind energy makes Estonia self sufficient and it does not need to import electricity). In general the subcontracting has been moving towards more value added as product development and engineering functions have been gradually added.

Tailor made solutions for smaller quantities where closeness to the markets is an advantage is another trend. In metal products BLRT is one of the biggest shipyards in the region and Tallink is one of the largest shipping companies in the Baltic Sea while tourism forms directly around 3% of the GDP of Estonia and indirectly 9,5% according to a European Commission survey(EC tourism survey Estonia country report).

Logistics sector has been historically important due to the location. The largest deepwater port is Muuga port on the eastern border of Tallinn with annual cargo was 2013 28 million tons, including container volume of 251,738 TEU’s. The other major ports are in Paldiski, Sillamäe and Pärnu. Also vehicles, notably Mercedes Benz cars reach the Russian market through a port in Estonia.

Wooden Houses

The wooden houses sector is rather strong with growing exports to quality conscious Scandinavia and especially Norway and is based on the large reserves of timber in the country and high tech craftmanship and innovative product development. For example, an Estonian company is building currently the world`s tallest 14 storey wooden apartment house in Norway. With over 90% of the wooden houses going to export, in 2013 Estonia became the biggest exporter of wooden houses in the EU with the total volume of over 200 million euros. This is based on a relatively numerous and strong cluster of local companies, but in September 2014 also a Swiss luxury house manufacturer set up its production in Estonia.

IT Information Technology

IT is of growing importance, for example the product development headquarters of Skype (now part of Microsoft www.skype.com) is located in Tallinn ever since it began as a startup in Estonia. This example has been followed by a number of tech startups like Transferwise (wire money at a fraction of cost, this year they reached a volume over billion £ and got Richard Branson on board as investor www.transferwise.com), GuardTime (digital data integrity service, customers mostly banks and governments www.guardtime.com), Fits.me (biometric robots www.fits.me), Fortumo (mobile payments www.fortumo.com), GrabCad (engineers` facebook, which recently made a 100M$ exit www.grabcad.com), Signwise (digital signatures www.signwise.me), Skeletontech (supercondensators for cars and trains www.skeletontech.com), TopConnect (travel sim, www.topconnect.com).

One area of growth is logically data centers for which the climate in Estonia is very suitable, one developer being for example the Data Valley Enterprises which is developing a 200 000 m2 data center near Tallinn (http://www.datavalleyenterprises.com/). Tallinn is often called a growing tech hub in Europe (BBC Next Silicon Valleys: Small Estonia has Big Ideas). This high concentration of tech startups aligns well with the e-government of Estonia and with the fact that Tallinn is the seat of the headquarters of the European Union IT Agency (EU Agency for large scale IT systems in Tallinn) and the NATO Cooperative Cyber Defence Centre of Excellence (https://www.ccdcoe.org/). Steve Forbes, having opened Forbes business in Estonia has said that „Estonia has been a particular success story. It has more startups per capita than any European state and has become something of a high-tech hothouse“. Steve Forbes highlights the example of Estonia`s sound fiscal policy as well.

Estonian Luxury

Then some final user and often design and luxury products and trade marks have finally emerged, like the super hifi Estelon Extreme speakers which the Consumer Electronics Association on 11.11.2014 gave the best hifi product 2015 award (www.estelon.com), Estonia pianos, popular in the US concert halls but now also entering China (www.estoniapiano.com), Joik ecocosmetics (www.joik.ee), having entered the Japanese market, Bolefloor (curved wooden floor an Apple executive bought for home in Silicon Valley www.bolefloor.com), luxury sailing yachts of Saare Paat (www.saarepaat.ee), Baltic Workboats aluminum ships used by Swedish coast guard for example (www.balticworkboats.ee) and Delta Powerboats (www.luksusjaht.ee), its Delta 54 IPS won the Motor Boat of the Year Award having competed against Azimut 55S, Fairline Targa 62GT, Sealine C48 and Mangusta 72.

Renard motorcycles is also a fine example of high end luxury Estonian products (http://www.renardmotorcycles.com/en/). Another very good example is Meiren Engineering, which has worked its way up in the niche of high tech award winning snowplows, which have advanced mechanical engineering combined with IT solutions which „read the road“ and adjust the plows accordingly, used by also by airports (www.meiren.ee).

These examples of reaching to the level of own final end products with higher value added and their own branding might not yet form a large share in the total business volume of the country, but show the trend, desire and capability to gradually grow that part of the economy which is beyond the cost effective and high quality subcontracting.

It is not realistic and actually not desirable to compete with Germans or Japanese in mass production of cars or with the Korea in mass consumer electronics, but rather to focus on smaller niche areas of high value added products which correspond to the size of the workforce and will not make the economy of a small country overly dependent on just one or two major products.

Estonia has been very welcoming to entrepreneurs from other countries. One of the first to come already back in 1993 was Sonny Aswani, a businessman from Singapore and the director of Tolaram group that has a major pulp and paper production in Estonia and he likes to say that: „I suggest my friends to wear sunglasses when coming here, as the future of Estonia is bright“. (Sonny Aswani Tolaram on 07.02.2014).

Originally from Finland but living in Estonia for years now Bo Henriksson, the chief of the ABB Baltics, a long time investor which has continually increased its operations in Estonia has pointed in his „8 reasons why ABB loves Estonia: „the working climate here is similar to the Nordic countries, in addition Henriksson also thinks that global economic trends favour production in those countries where demand is close by (Henriksson: 8 reasons why ABB loves Estonia). Giuseppe Carnevali from Italy, the founder and president of Navionics, the world leading sea navigation company which by the way came to market with the first ever electronic plotter in 1984, in 2013 established the company`s technology development center in Estonia has said that „in Estonia you can feel the technology in the air, its like Silicon Valley“ (Carnevali – the case of Navionics establishing the IT center in Estonia).

Estonia ranks in the top 30% of European countries with the best payment discipline

Having two countries with the same average yield level does not mean the net cash flow from tenants reaches the property owner with the same security and speed. Having a higher yield where the tenants tend to be regularly late or even in default with their payments can seriously affect the actual NOI (net operating income) of the property owner, regardless of the initial projected yield at which the property was purchased. Intrum Justitia has issued since 1998 the European Payment Index, a survey of 31 countries ranking their overall payment discilpine and risks (Intrum Justitia European Payment Index 2014).

Rising the hypothesis in this market review that even if the proposed average yield would be slightly higher for example in Romania compared to Lithuania, then one should also look at the country`s ranking in the payment index and find out that Lithuania with the value of 163 ranks # 15 compared to Romania which ranks # 25 with a substantially higher risk of payment value of 189, categorized as „high urgency“ in Intrum Justitia Index. Perhaps according to this example Lithuania makes a better place to purchase the property compared to Romania, even if the latter would have slightly higher average yield level.

(contribution for this article from our member in

The Nordic Baltic Channel for Media and Industries uses cookies to increase performance, however, caring about your privacy, selecting the cookies,

The Nordic Baltic Channel for Media and Industries uses cookies to increase performance, however, caring about your privacy, selecting the cookies,